|

Listen to this article |

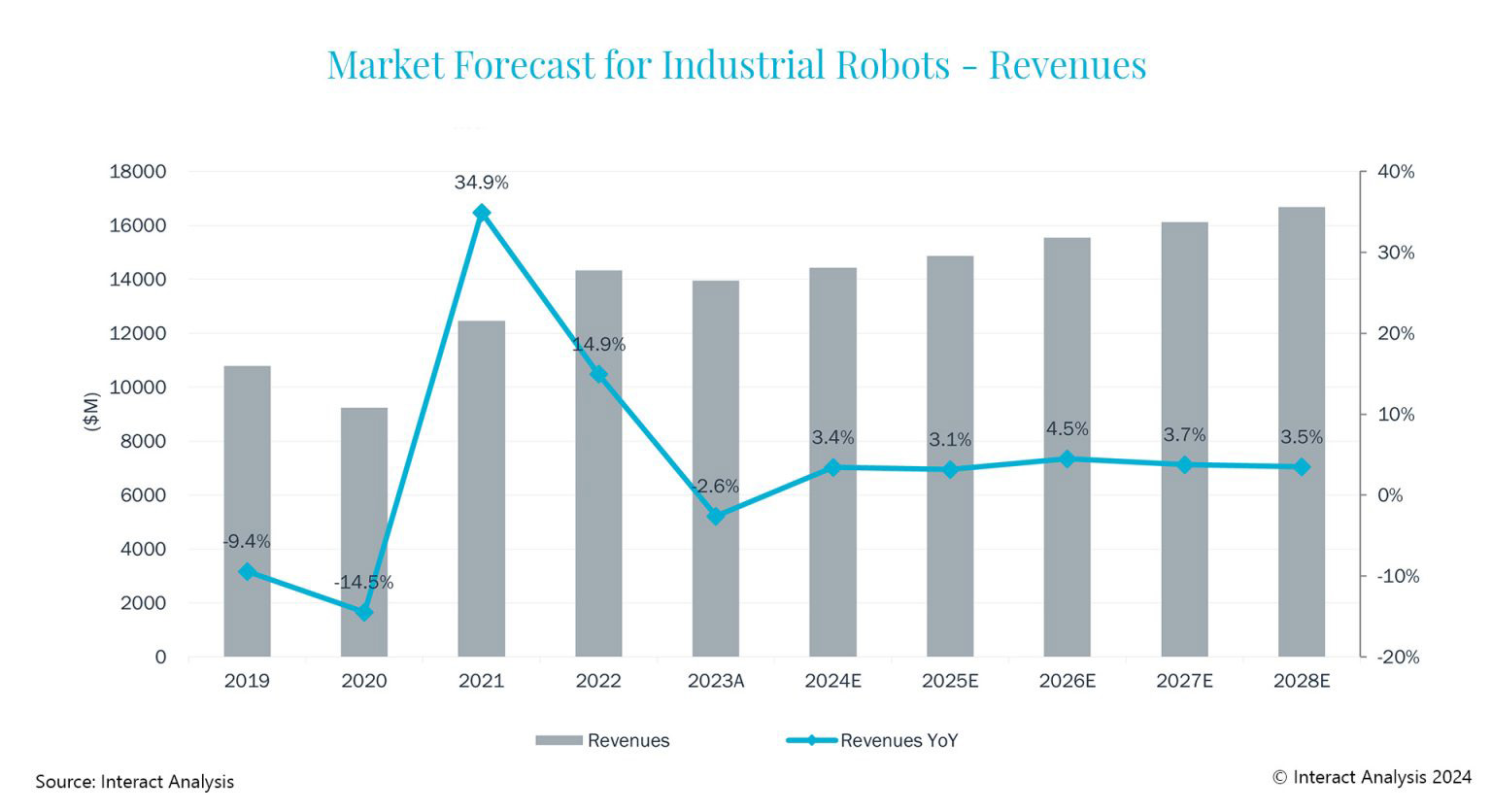

The industrial robot market is expected to grow by ~3.7% per year between 2024 and 2028. | Source: Interact Analysis

Overall global industrial robot shipment volumes exceeded 500,000 units in 2023, Interact Analysis reports. The global market research firm says the industry is starting to bounce back from a 2023 low point.

Industrial robot shipments are similar to levels seen in 2022, although the average price of industrial robots decreased last year. The market saw record highs in 2021, and lows in revenues and shipments in 2023.

“The average price per unit of an industrial robot is on a downward trajectory, following a rise for two consecutive years, and we expect a price decline of around 3% per year between 2024 and 2028. The COVID-19 pandemic coupled with high energy prices and inflation caused an average price increase in 2022,” Maya Xiao, research manager at Interact Analysis, said. “We originally expected robot prices to decrease again in 2023, but ongoing supply chain and inflation issues resulted in prices creeping up to levels close to those seen in 2022. This increased “price effect” was also partially due to the market trend towards heavy payload robots, which are materially a more expensive product.”

In the long term, however, the outlook remains positive. Interact Analysis expects the global industrial robot market to grow on average by 3.7% per year between 2024 and 2028.

Breaking down the industry by region

Breaking down the industry by region, sales of industrial robots to the automotive industry in the Americas faced significant pressure in 2023. This resulted in slow growth for this segment of the market, one of the largest downstream industries for industrial robots in the region.

According to Interact Analysis, Mexico, in particular, is highly dependent on the automotive industry, creating a greater impact on industrial robot sales in the region. Growth of industrial robots in the Americas dropped by 17.3% in 2023. In comparison, APAC saw a slight increase in growth, and EMEA remained stable.

The American markets accounted for around 17% of global industrial robot revenues, compared to 62% for APAC and 22% for EMEA. In the Americas, the industrial robot market saw strong growth immediately post-COVID in both the automotive and non-automotive industries. This is because these manufacturers were continually looking for ways to improve their production processes and reduce manufacturing costs by adopting the technology.

3 common applications for industrial robots

The top three most common applications for industrial robots are material handling, welding, and assembly, according to Interact Analysis. These accounted for over 70% of industrial robot market revenues in 2023, with material handling accounting for one-third on its own.

This application is particularly dominant in the Americas and Europe. The American market has the highest market concentration globally, where the top 5 suppliers share nearly 80% of revenues and over two-thirds of unit shipments.

“It is important to note that our robotics forecasts are underpinned by the Interact Analysis Manufacturing Industry Output (MIO) Tracker,” Xiao said. “We can see from our data that the growth profile for industrial robots reflects the manufacturing slowdown during the pandemic era and the subsequent downturn in 2023. If we take a look at the manufacturing output figures for China, Europe and the Americas, the historic manufacturing contractions are synonymous with the decline in growth for the industrial robot market that we have observed in recent years.”

According to the Association for Advancing Automation (A3), robot sales continue to be slow in North America. A3 said robot sales in North America were down 6% in the first quarter of 2024 compared to the same period in 2023. Companies purchased 8,582 robots from January through March for a total of $494 million, A3 said.