A new report from TrendForce reveals that “significant capital investments” have been made in the memory sector due to HBM’s high ASP and profitability.

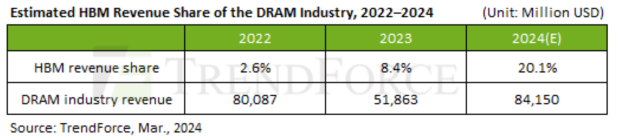

Estimated HBM revenue share of the DRAM industry 2022-2024 (source: TrendForce)

VIEW GALLERY – 3 IMAGES

According to TrendForce Senior Vice President Avril Wu, by the end of 2024, the DRAM industry is expected to allocate around 14% of its total capacity to making HBM, with an estimated annual supply bit growth of around 260%. Also, HBM’s revenue share is expected to increase to around 20.1% by the end of the year, up from the 8.4% that HBM had in 2023.

Wu continued, saying that in terms of production differences between HBM and DDR5, the die size of HBM is around 35-45% larger than DDR5 even on the same process and capacity (comparing 24Gb to 24Gb). Yield rates including TSV packaging (Through-Silicon Via) for HBM is around 20-30% lower than DDR5, with the production cycle taking 1.5 to 2 months longer than DDR5.

HBM’s longer production cycle of over 6 months from wafer start to final packaging sees customers like NVIDIA and AMD having to scoop as much HBM3 and HBM3E memory as possible, with TrendForce reporting that most orders for 2024 have already been submitted to suppliers, and are non-cancellable unless there are failures in validation.

Estimated HBM/TSV capacity by supplier for 2023-2024 (source: TrendForce)

Samsung looks to lead HBM production for 2024, with TrendForce expecting Samsung’s total HBM capacity to hit around 130,000 (including TSV) before the end of the year, with SK hynix creating 120,000 but “may vary based on validation progress and customer orders”.

When it comes to the more mainstream HBM3 — now that HBM3E is gearing up — is owned by SK hynix, with over 90% of the HBM3 market share. Samsung will continue to ramp up its HBM3 supply to AMD and its Instinct MI300X AI GPU over the coming quarters, adds TrendForce.