The HBM market is unstoppable right now, attached to the insatiable AI demand that is fueling SK hynix and Micron to sell all of their HBM memory allocation for 2024, and 2025.

VIEW GALLERY – 2 IMAGES

In a new report from TrendForce, Senior Research Vice President Avril Wu says that the HBM market is poised for robust growth, “driven by significant premiums and increased capacity needs for AI chips“. HBM unit sales are multiple times higher than conventional DRAM, and about 5x higher than DDR5.

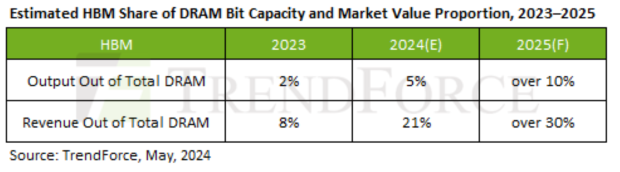

Wu explains: “This pricing, combined with product iterations in AI chip technology that increase single-device HBM capacity, is expected to dramatically raise HBM’s share in both the capacity and market value of the DRAM market from 2023 to 2025. Specifically, HBM’s share of total DRAM bit capacity is estimated to rise from 2% in 2023 to 5% in 2024 and surpass 10% by 2025. In terms of market value, HBM is projected to account for more than 20% of the total DRAM market value starting in 2024, potentially exceeding 30% by 2025“.

The TrendForce report continues: “Wu also pointed out that negotiations for 2025 HBM pricing have already commenced in 2Q24. However, due to the limited overall capacity of DRAM, suppliers have preliminarily increased prices by 5-10% to manage capacity constraints, affecting HBM2e, HBM3, and HBM3e. This early negotiation phase is attributed to three main factors: Firstly, HBM buyers maintain high confidence in AI demand prospects and are willing to accept continued price increases“.