|

Listen to this article |

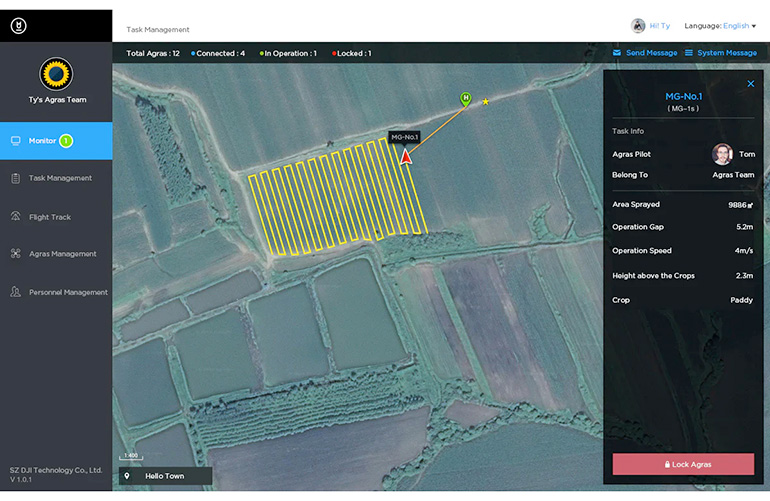

An agricultural industry group is fighting to keep DJI as a vendor due to the ease of use for its software. | Credit: DJI

A coalition of agriculture-specific drone operators and service providers has formed to lobby against the proposed Countering CCP Drones Act (H.R.6572) currently working its way through Congress. This bill would ban the sale of drones from Shenzhen Da-Jiang Innovations Sciences and Technologies Co. , or DJI, in the U.S.

This coalition consists of Agri Spray Drones, Bestway Ag, Drone Nerds, HSE-UAV, Pegasus Robotics, and Rantizo. It said intends to represent, protect, and advocate for the interests of the agricultural industry in the use of spray drone technology.

The group warned that if the U.S. government bans Chinese-made drones like those of DJI, commercially available options for high-capacity spray drones would be limited. This could lead to lead to a monopoly situation with only one provider — Helio. This would reduce innovation, increase prices, and limit options for farmers and service providersm

In April, Anzu Robotics, a new U.S.-based drone supplier launched an alternative to the DJI Mavic camera drone. Its strategy is to license and manufacture a clone of the company‘s Mavic outside of China and provide a new software solution for the drones.

This strategy would have circumvented the intent of the Countering CCP Drones Act, but recent amendments to the bill now include Anzu Robotics.

Banning DJI could set back the agriculture industry

“The advancement of my bipartisan bills, the Countering CCP Drones Act and the FACT Act, is a win for America’s national security and a win for Americans whose data and critical infrastructure has been collected and monitored by our adversary Communist China,” stated Congresswoman Elise Stefanik (R-N.Y.). “Congress must use every tool at our disposal to stop Communist China’s monopolistic control over the drone market and telecommunications infrastructure and build up America’s industrial capacity.”

In response, the industry coalition said that there currently are no affordable and viable alternatives to DJI drones for use in agriculture spraying operations. On a recent call with the group, The Robot Report learned more detail about how important DJI drones are for the industry.

The primary use cases at risk is the application of chemical insecticides, herbicides, and fertilizers using aerial sprayers, said the group members. The use of semi-autonomous and fully autonomous drones has evolved over the past decade. The alternatives to drone-based application of chemicals are ground-based tractors and manned planes (crop dusters).

Across the U.S., local service providers have emerged to provide aerial-based services for farmers.

The drone that sparked the initial growth of this market was the DJI MG1P. The eight-rotor model had a 10L (2.6 gal.) liquid storage capacity and a list price of $15K. The company now sells several models at different price points including the T30L, T40, and AGRAS T50L, with 30, 70, and 75 L (7.9, 18.4, and 19.8 gal.) capacity, respectively.

The group asserted that there is no other agricultural spraying drone with the same capabilities at the same price points. The service providers in the group also said the ease of use and features of DJI’s software are currently unmatched in the industry.

Industry group raises multiple concerns

- Choice and competition: The group said that banning Chinese-made drones would limit commercially available options for high-capacity spray drones. This could stifle innovation and increase costs for farmers and service providers, they said.

- Data security and privacy: The industry is looking to develop standards and solutions, such as Rantizo’s AcreConnect app, to ensure data security and privacy without relying on cloud-based storage with drone manufacturers.

- Regulatory uncertainty: The proposed Countering CCP Drones Act has created uncertainty and concern within the industry about the future availability and use of drones.

- Lack of understanding of industry impact: The coalition members expressed concern that policymakers may not understand the implications of a DJI drone ban on the agricultural industry.

- Opportunities for rural economic development: Drones have created new revenue streams and job opportunities in rural communities, especially for younger generations, said the drone service providers. Maintaining access to affordable and innovative drone technology is seen as critical for sustaining this growth, they said.

The group said its bottom line is preserving choice, competition, and innovation in the drone industry to support the needs of farmers, service providers, and rural economic development.

Representatives on the call included:

- Jeremy Schneiderman, CEO, Drone Nerds

- Bryan Sanders, president, HSE-UAV

- Jeff Dickens, region lead, Upper Southeast, Rantizo

- Jeff Clack, Bestway Ag

- Taylor Moreland, CEO, Agri Spray Drones

- Eric Ringer, vice president of strategy and partnerships, Rantizo

- Jeff Clack, drone division supervisor, Bestway Ag