|

Listen to this article |

Estun was among the many companies showing humanoid robots at CIIF in China. Credit: Georg Stieler

Over the past three years, more than half of the world’s robots were sold in China. While not historically seen as a technological leader in robotics, China is increasingly setting global trends in this industry. Georg Stieler, head of robotics and automation and managing director for Asia at STM Stieler Verwaltungs-GmbH, shared his impressions from this year’s China International Industry Fair, or CIIF, in Shanghai.

CIIF was packed, despite a sales slowdown

Even as China is facing its worst economic sentiment in 20 years, CIIF was vibrant and full of energy. We estimate a 20% drop in industrial robot sales in the first half of the year—mainly due to a cooling investment boom in electric vehicles, batteries, and photovoltaics

However, there are bright spots in the country‘s market: 3C (computers, communication, and consumer electronics) is gaining in importance again. Also, collaborative robots are on a growth path, driven by applications in electric vehicle production and inspection.

Robot manufacturer exhibits show key themes at CIIF

The leading robotics manufacturers focused on the following key themes at the exhibition:

- FANUC presented applications for battery production, cutting, painting, palletizing, and semiconductor manufacturing, as well as dynamic uses of cobots. However, as the market statistics suggest, the Japanese company is facing challenges because to its high price levels compared with local competitors in the latter segment.

- ESTUN showcased its wide product range and industry-specific solutions, particularly in the battery, solar, and automotive sectors. The Chinese company featured cobots more prominently than in 2023.

- KUKA and ABB demonstrated applications that highlight the technical strengths of their robots and differentiate them from local competitors. ABB introduced the Ultra Accuracy feature for its GoFa cobot for ultra-precise applications in the electronics, automotive, aerospace, and metalworking industries.

In addition, exhibitors highlighted the following topics at the event in China:

Cobots in EV production

Credit: Georg Stieler

Assembly and inspection applications in batteries and electric vehicles have become a major growth driver for cobot sales. Universal Robots, Aubo, JAKA Robotics, and Flexiv prominently presented their respective systems for this field.

Cobots with 30-40 kg payload

Credit: Georg Stieler

Complete palletizing systems, including cameras, grippers, and software, start at €12,000 ($13,157 U.S.) — significantly less than comparable offerings in Europe or the U.S. Pictured above is a FANUC system at the upper end of the price range.

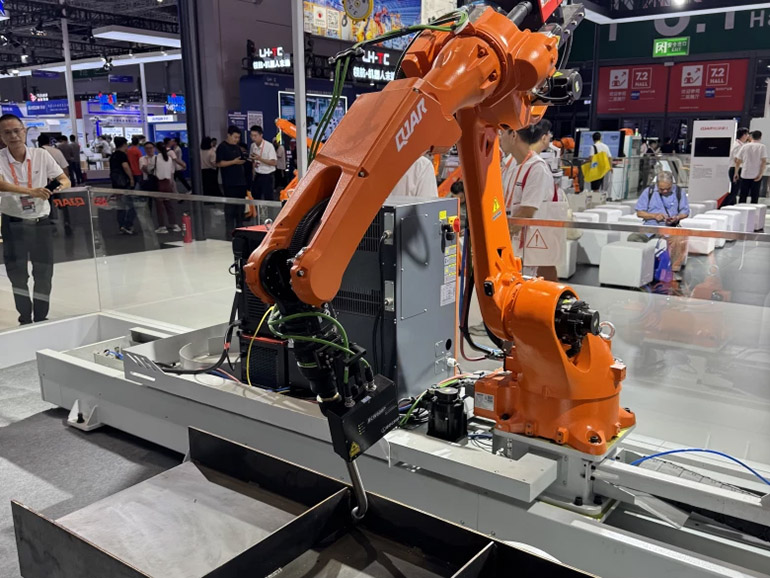

Intelligent welding solutions

Credit: Georg Stieler

3D cameras and automated path planning were featured by all major cobot manufacturers. QJAR, a domestic supplier, presented a large-scale welding system for steel structures and claimed to have sold 2,000 robots in a single batch, doubling its sales.

Heavy load robots take to the floor at CIIF

Credit: Georg Stieler

Accordingly, FANUC, ESTUN, ABB, Yaskawa, and others demonstrated their capabilities in this field. Mech-Mind demonstrated a product to streamline battery pack assembly using 3D cameras and intelligent path planning.

We expect robots with payloads of 300 kg (661.3 lb.) and higher to be used in more palletizing applications within industries such as chemicals, food and beverage, as well as warehousing and logistics.

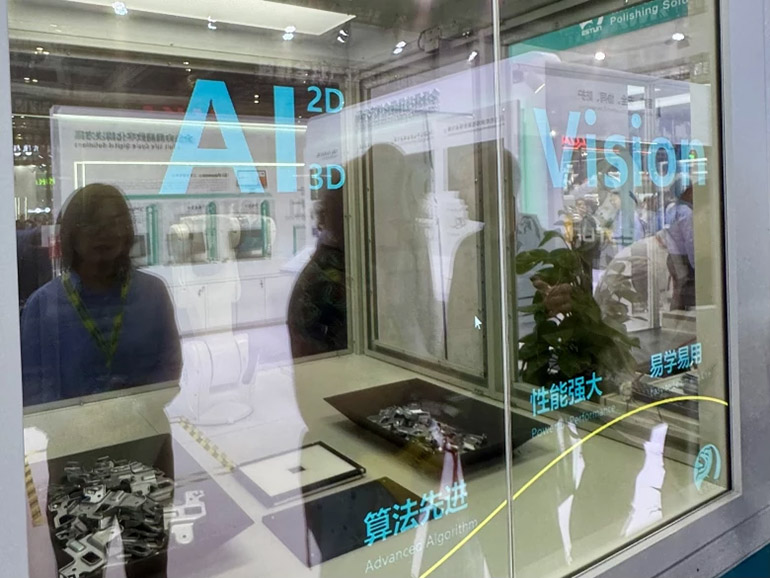

Computer vision and AI

Credit: Georg Stieler

Mech-Mind show its improvements for handling shiny and reflective surfaces, as well as its own large language model (LLM) interface. HIKVISION highlighted 3D-guided welding and advanced inspection tasks and co-exhibited an integrated inspection solution with ESTUN. Agilebots and Micro-Intelligence, a start-up, presented a model in which robots assembled building blocks autonomously.

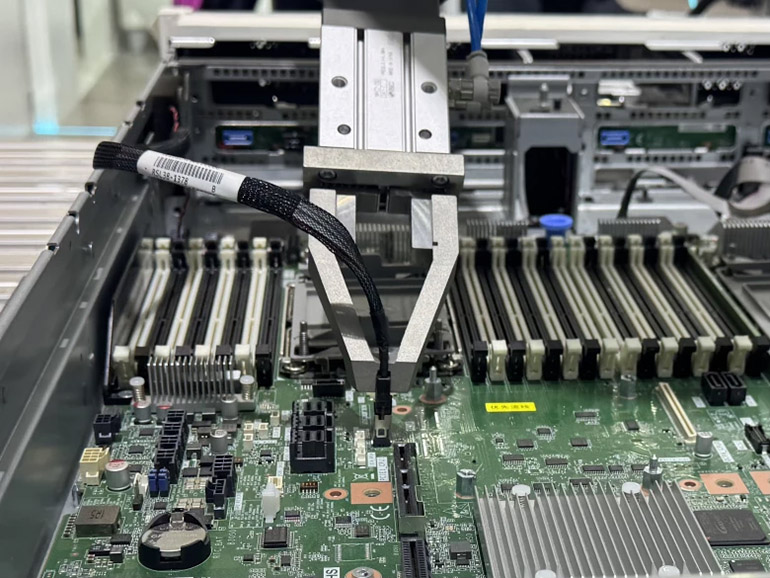

Advanced tactile intelligence

Credit: Georg Stieler

Flexiv and JAKA showed advanced wire-harnessing applications, relying on force sensors and dynamic force control.

Inovance displays ambitions at CIIF

Credit: Georg Stieler

Inovance, known as the “little Huawei,” presented its industrial robots in an automotive body-in-white setting (see above). After taking market share from established Japanese players in the SCARA segment, this highlighted the Shenzhen, China-based company‘s ambition in multi-axis robotics.

Robots currently contribute less than 5% to Inovance’s revenue, but given its strong position in industrial automation, this could change quickly. Inovance’s real-time synchronous industrial wireless module offered a glimpse into its vision for the future.

Humanoid robots ubiquitous at CIIF

ESTUN, JAKA, and many other companies presented humanoid robots. So far, they serve more as proof of Chinese firms’ capabilities to churn out new hardware quickly.

Even the more promising models are still years away from successful commercialization.

Who will still be around in two to three years?

The robotics sector remains hot in China, but many companies at CIIF, despite their large booths, are not yet profitable. The question remains: who will still be around in two or three years?

Inovance and ESTUN stood out, but the future is less certain for others.

Foreign companies must become more Chinese to be successful

Foreign firms face challenges in this competitive environment. Higher prices are one hurdle; another is the lack of local engineering capacity. Special requests sent to Europe are often delayed or lost.

Universal Robots just signed a strategic partnership with Gree Intelligent Equipment in Zhuhai to address these issues.

On September 25, 2024, Gree Intelligent Equipment and Universal Robots officially signed a strategic cooperation agreement in Zhuhai to establish a strategic partnership. 🤝#GreeGlobal #GreeIntelligentEquipment pic.twitter.com/YkldQqvOeq

— GreeGlobal (@G_zhuhai) September 27, 2024

While Western politicians call for decoupling, many European companies are doing the opposite, increasing their sourcing from China for greater flexibility and faster product development.

Automotive suppliers are even adopting “Go East” strategies to reduce investment costs in Europe by sourcing machines and robots from China.

Domestic market has a mixed outlook

While some expect a sales pickup towards the end of the year, others remain pessimistic.

However, even if the Chinese market shrinks by 20% this year, it will still be five times the size of the U.S. market and three times the size of the EU’s.

Chinese robotics companies push abroad

One thing is certain: Intense competition in the domestic market, attractively priced products, and a powerful ecosystem rapidly producing new systems at unmatched speed and cost are driving China’s robotics industry. With extensive application knowledge from the world’s leading manufacturing hub, Chinese robotics companies are expanding abroad.

Expect to see much more of them in Asia, the EU, and the U.S. As I finish this summary, Inovance has just announced plans to exhibit its industrial robots at SPS in Nuremberg, Germany, this coming November.

About the author

About the author

Georg Stieler is managing director for Asia at international consulting firm STM Stieler.

Editor’s note: This article is reposted with permission from the author.