|

Listen to this article |

Robots and automation have expanded at different rates, depending on the industry. Construction is widely regarded as conservative in its interest in new technologies. However, in its 2024 “Tools, Equipment, and Robotics Benchmarking Report,” BuiltWorlds reported that industry attitudes are starting to change.

BuiltWorlds is a Chicago-based member network dedicated to inspiring and advancing innovation in the architecture, engineering, and construction (AEC) industry. It conducts an annual survey on category-specific technology adoption and usage.

The latest report revealed that while the AEC industry has been slow to adopt robotics overall, there has been progress in certain areas.

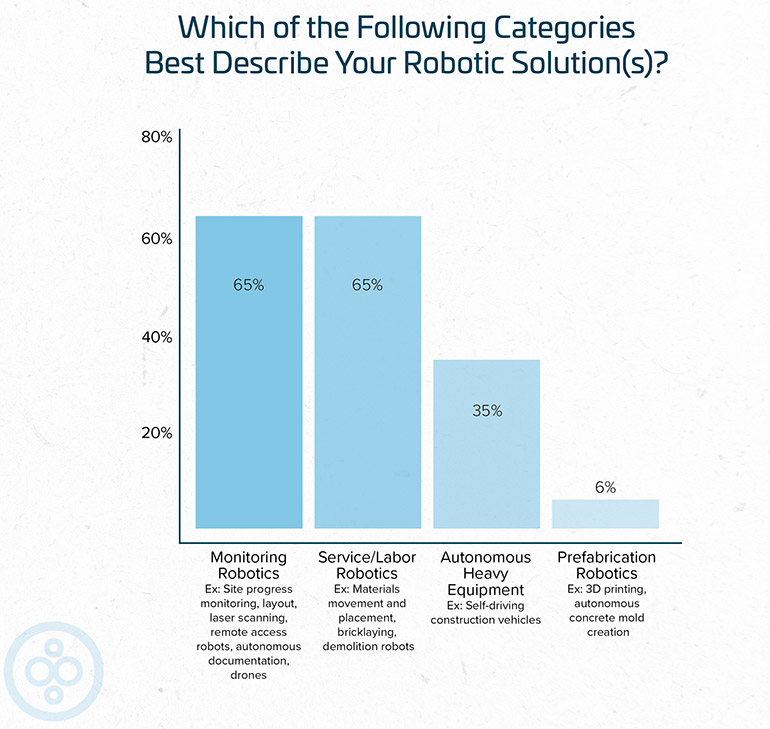

“The integration of advanced tools, equipment, and robotics represents a significant leap toward modernizing and streamlining operations within the AEC industry,” wrote Audrey Lynch, the BuiltWorlds research analyst who authored the report. “This year, we saw the highest levels of adoption in monitoring robotics and service/labor robotics, two of the four main categories we’ve identified in construction robotics.”

BuiltWorlds reports increasing robot utilization

Nearly two-thirds of the surveyed contractors who use robotics on jobsites are using monitoring and/or service or labor robotics. Thirty-five percent said they are using autonomous heavy equipment, while only 6% said they’re using prefabrication robotics.

“There is a confluence of factors that are all working in tandem to drive increased utilization of robotics in the construction industry,” stated Tyler Sewall, senior director of research at BuiltWorlds. “The primary push forward is an increasingly prominent labor shortage in the industry.”

“Statistics now indicate there are over 500,000 open positions in the industry, and that number is expected to continue to grow,” he told The Robot Report. “To mitigate that risk, the industry is preparing to turn to robotics to supplement the available labor force.”

“Meanwhile, the typical barriers to adoption are slowly waning, leading to an environment more receptive to robotic solutions,” added Sewall. “The increased use of BIM [building information models], improved operability and accuracy, improved data collection and utilization, and an industry more culturally inclined to new technologies have all yielded material increases in the use of robotics.”

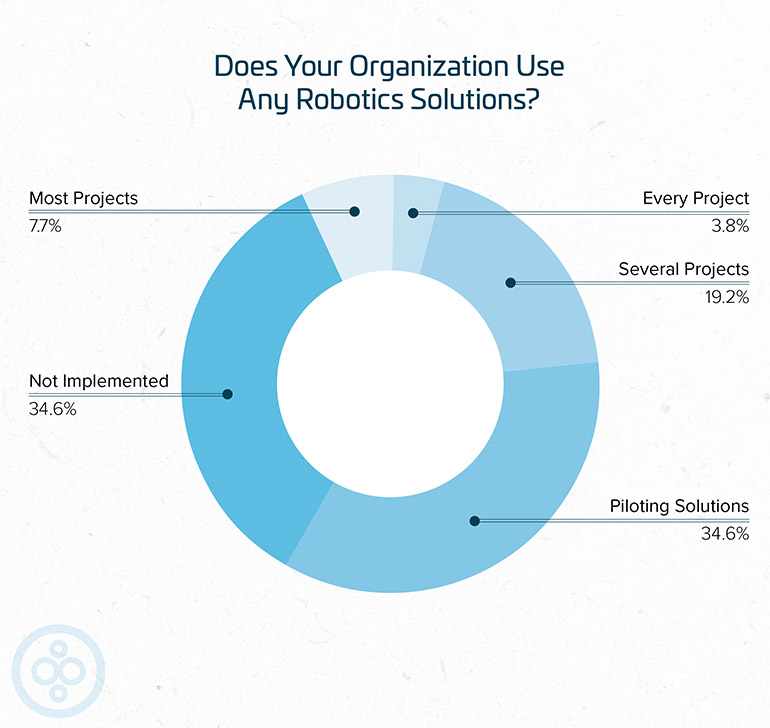

An annual survey found that nearly two-thirds of contractors are using some form of automation. Source: BuiltWorlds

Dusty Robotics is a leading provider

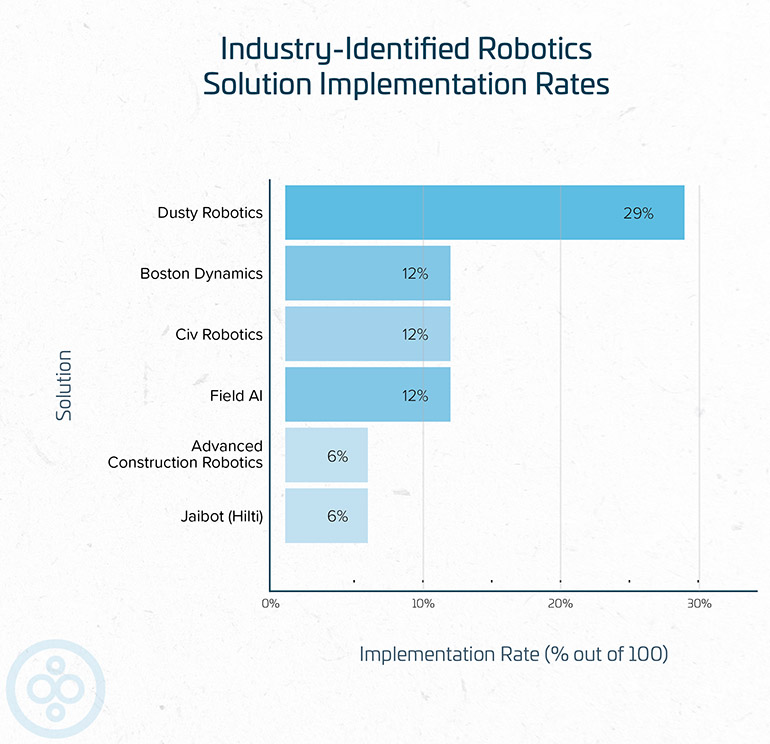

Among the multiple robotic technology providers named in the report, one provider stood out as both most implemented as well as highest rated: Dusty Robotics, which builds robots to help in laying out jobsites.

“Dusty Robotics consistently outperforms the industry average across all evaluated criteria, indicating its strong market position,” Lynch wrote. “With top ratings in adoption/utilization, ease of use, coordination with site activities, and data integration, the solution demonstrates its effectiveness and user-friendliness.”

“It also excels in installation/performance speed and quality — tied with Civ Robotics — highlighting its reliability and efficiency,” he said.

Dusty Robotics is a leading brand in construction robotics implementation, found the survey. Source: BuiltWorlds

Why ‘better adoption’ isn’t ‘mass adoption’

But while this year’s report shows wider scale adoption than years previous, particularly in the areas of service/labor and monitoring robotics, the industry has yet to embrace robotics into its mainstream, said BuiltWorlds.

“As much as the case for robotics continues to grow, there are, frankly, still so many reasons why robotics adoption isn’t widespread, and may not be for a while,” Sewall said.

For one, most construction robots require some variety of building model in order to operate. “BIM, while well-adopted in some markets, is significantly underutilized in large portions of the industry,” explained Sewall.

Another reason is that robotics, like any new technology, comes with a certain amount of risk—which is a problem in a traditionally risk-averse industry, he acknowledged.

“With layout robots, for instance, the second question is always, ‘Who owns the layout,’” Sewall said. “If the general contractor dictates how layout will be done, does that change the owner of the risk?”

Finally, and most obviously, is the cost.

“The up-front costs of robotic solutions are expensive,” Sewall said. “While larger companies can support these costs, many small and midsized contractors simply cannot support any additional spend.”

Still, while there remain significant barriers to mainstream adoption of construction robotics, the data seems to indicate a slow acceptance and utilization of a technology that BuiltWorlds said represents a massive boost to safety, efficiency, and productivity.

Monitoring and materials movement systems were the most cited types of robots used in construction. Source: BuiltWorlds