A3 executive vice president Alex Shikany speaking at Collaborate North America 2025. | Credit: Brianna Wessling, The Robot Report

While 2024 was a slow year for the robotics industry, the Association for Advancing Automation (A3) is more optimistic about 2025.

After a slow first three quarters of the year, A3’s latest robotics statistics show a strong ending to 2024. North American companies ordered 8,277 robots valued at $506 million in Q4, reflecting 8% growth in both units and revenue compared to Q4 2023. Food and consumer goods led the quarter with 77% year-over-year growth, driven by seasonal demand and continued investment in automation, A3 said.

“There’s a lot of optimism and a lot of signals right now that 2025, and even into 2026 and 2027, being strong years for automation,” Alex Shikany, executive vice president of A3, told The Robot Report last week at Collaborate North America 2025.

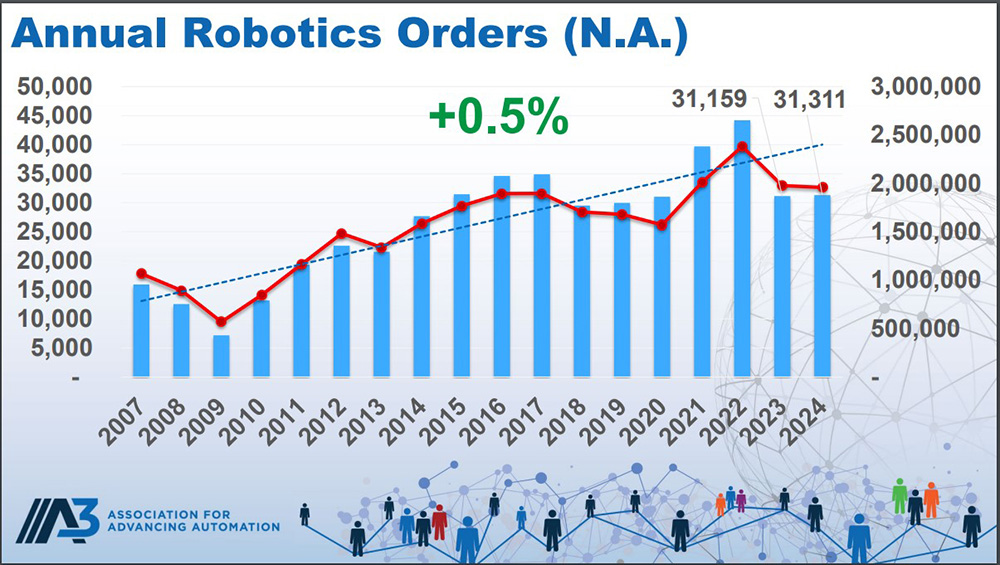

Overall, North American companies ordered 31,311 robots valued at $1.963 billion, representing slight increases of 0.5% in units and 0.1% in revenue over 2023.

Register today to save 40% on conference passes!

Register today to save 40% on conference passes!

What’s going on in the automotive industry?

Despite Q4’s gains, robot sales in the automotive industry remained slow. While traditionally a strong supporter of robotics, automotive orders declined 15% in 2024 compared to 2023, according to A3. However, Shikany believes automotive orders will bounce back by the end of 2025.

“I think there is room to grow in automotive,” he said. “What we saw over the last two years, with the lower quantities of orders, had a lot more to do with manufacturers pivoting their strategies with regard to not getting the performance they thought they would get out of all their electric ambitions.”

Many automotive companies bet on consumers buying electric vehicles (EVs) in droves. However, EV adoption has been slower than expected for many automakers.

“What I’m seeing and hearing now is that there’s a wave coming from the automotive industry, and it hasn’t hit shore yet,” Shikany said.

“The automotive industry is a mature market relative to robotics. It’s been around a long time, and they are not strangers to deploying robots,” he continued. “But they often need to retool their assembly and manufacturing lines to accommodate new vehicles and things.”

Food & consumer goods, life sciences drive growth

North American robot orders have fallen in recent years but remained mostly steady in 2024. | Source: A3

Food and consumer goods emerged as 2024’s fastest-growing sector, with robot orders surging 65%. Life sciences, pharmaceuticals, and biomedical were other industries that posted strong results with 46% growth in orders.

Shikany said the biggest areas of growth for robotics in the years to come will be in consumer-driven industries, including warehousing, agriculture, and construction. People will always need food and housing, and they likely won’t stop shopping online any time soon.

“You see a bunch of malls closing all over the United States,” he said. “Gone are the days when brick and mortar were the way that you get your shopping done.”

Other sectors, like semiconductors and electrics, didn’t have a strong end to 2024. Semiconductor and electronics orders fell by 37% annually, reflecting supply chain pressures and cooling demand, while metals saw a 4% decline.

Geographically in the United States, Shikany said he sees a lot of robotics potential in the Midwest and Rust Belt. “There’s just a diverse range of industries with a high density of companies in this area of the country,” he said. “If you look at their adoption of our technologies, they’re at a relatively low rate compared to what the opportunities are.”

Constraints moving forward

Shikany said 2025, particularly the second half, will be positive for robotics. But, of course, there are still things to be wary of. For example, small and medium-sized enterprises still often see robotics as too complicated to implement.

“Some companies believe that robotics automation is too much to bite off, so to speak. We don’t need to automate [in the U.S.], we can continue to do business we’ve always done it and be just fine,” he said. “But that’s becoming less true by the day, as more companies across the world are adopting these technologies.”

Additionally, some employees still see robotics as competition or a threat to their jobs.

“Time and time again, we have documented that with many companies, the exact opposite happens,” he said. “Employees have more satisfaction in their jobs and their work when they get to work with upgraded tech.”

“Robots are going to be working alongside people for many years to come,” Shikany said. “I think you will eventually see ‘lights out’ facilities achieved, but frankly, I believe that’s going to require a ground-up vision, where every step of the process from planning that facility through designing it has all the necessary technology ready for it.”

Shikany warns that companies that don’t automate run the risk of falling behind.

“If you’re sitting there, and you’re saying to yourself, it’s too complex, it’s too expansive, you’re going to be left behind,” he said. “Or, your competition is going to be the one that ends up adopting it, and you’re going to be at a disadvantage.”

A3 president Jeff Burnstein recently wrote an open letter to the Trump administration that said automation is key to reshoring manufacturing to the U.S. He recommended that the federal government work with the robotics industry to develop a strategy to effectively compete economically and in national security.