|

Listen to this article |

The IFR considers service robots to include this automated guided vehicle (AGV), which can move up to 20 tons in a warehouse. Source: Stäubli

Sales of professional service robots have increased by 30% worldwide, according to the International Federation of Robotics, or IFR. The Frankfurt, Germany-based organization said that its statistics department registered more than 205,000 units in 2023.

Nearly 80% of the such robots came from the Asia-Pacific region, with 162,284 units sold. Europe followed with 33,918 units, and the Americas with 8,927 units sold, according to the IFR’s World Robotics 2024 Service Robots report.

“The service robotics industry is on the move,” stated Marina Bill, president of the IFR. “More and more robots are serving on factory floors, in shopping centers, or helping with deliveries on the street.”

Top applications are in logistics, hospitality

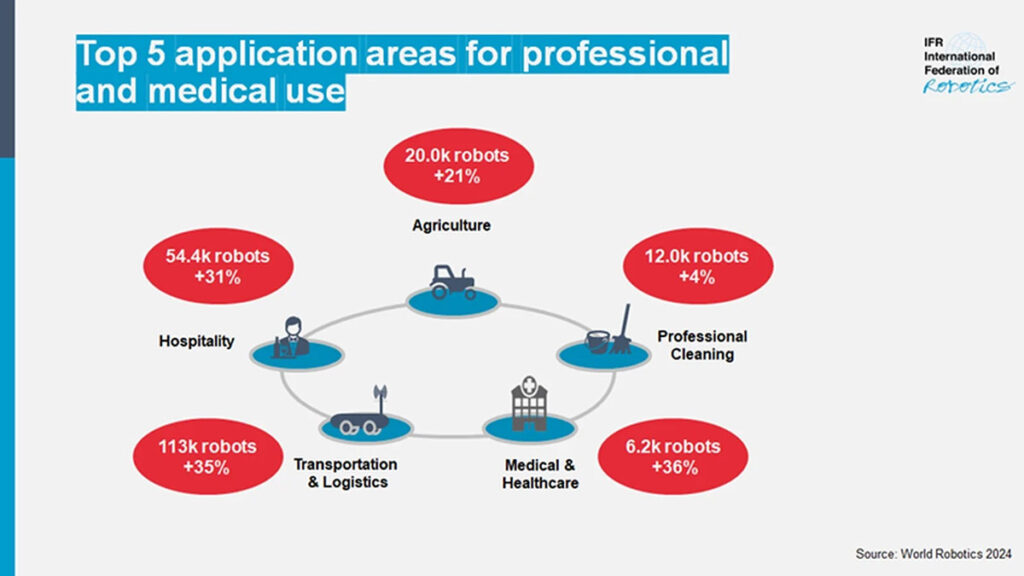

More than one in two professional service robots sold in 2023 were built for transportation and logistics applications, noted the IFR. Sales grew by 35%, with nearly 113,000 units sold in 2023.

“As the industry suffers from a significant labor shortage, there is a strong demand for technological support,” the organization said. “For example, one of the most time-consuming tasks for truck drivers is loading and unloading, where robotic applications offer dedicated solutions for automation. Making the application easy to use and understand for non-technical staff is key to adoption.”

A shortage of skilled labor is also driving demand for automated deliveries in outdoor environments without public traffic, the group said. Robot types in this class range from automated conventional vehicles, such as forklifts or tractors, to customized systems, which often have a weatherproof enclosure for the goods being transported. The IFR also cited robots for truck loading and unloading.

Hospitality robots are also becoming increasingly popular, said the IFR. More than 54,000 units (an increase of 31%) were sold in 2023. Robots for mobile guidance, information, and telepresence accounted for the majority of these robots.

As the sector is evolving rapidly, some key applications have emerged, such as food and beverage preparation, as well as guidance and information points in public environments.

Sales of agricultural robots showed strong growth of 21%, with almost 20,000 units sold in 2023. The shortage of human labor in times of demographic shifts and the demand for more sustainable precision agriculture drove demand for field robots, the IFR said.

The market for professional cleaning robots grew by 4% to almost 12,000 units sold. The main application is floor cleaning, which represented approximately 70% of the units sold in this application group.

In accordance with ISO standard the World Robotics 2024 yearbook considered medical robots as a third category alongside service robots and industrial robots: Sales of medical robots increased by 36% to around 6,100 units in 2023.

Sales of rehabilitation and non-invasive therapy robots were up 128%. Demand for surgical robots rose by 14%, and sales of robots for diagnostics increased by 25%.

As with industrial automation, the IFR said that more work needs to be done on safety standards and that generative AI promises to improve robot performance and applicability. It described humanoids as a potential disruptor.

Click here to enlarge. Source: IFR

IFR identifies leading countries supplying medical, service robots

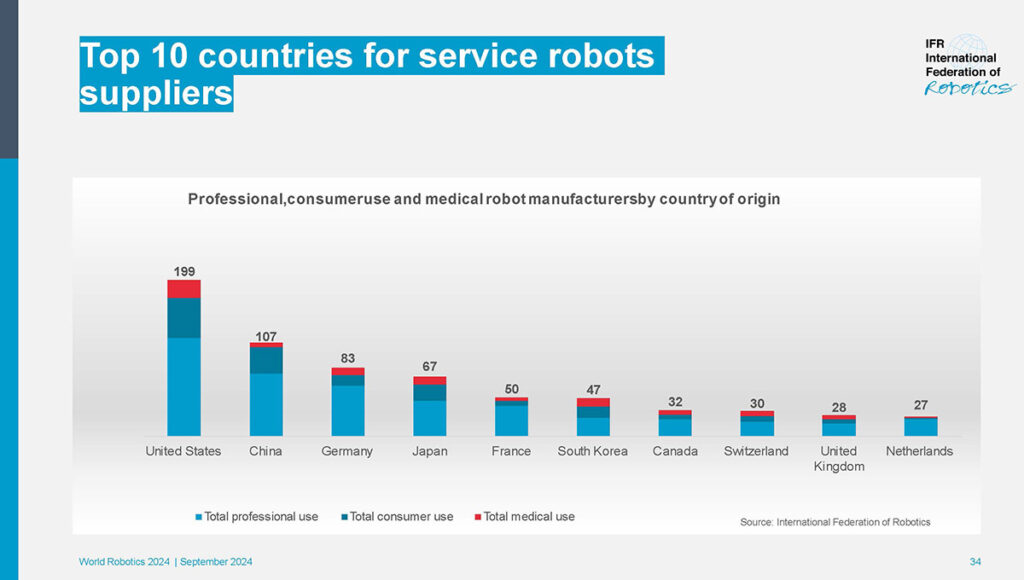

The U.S. is home to the largest number of service and medical robot manufacturers in the world, with 199 companies headquartered there, according to the IFR. Sixty-six percent of these manufacturers produce professional service robots, 27% consumer service robots and 12% medical robots.

China ranked second with a total of 107 service and medical robot manufacturers. The proportion of companies offering professional service robots is even higher than in the U.S., at 80%. A total of 34% offer consumer robots and only 5% medical robots.

Germany ranked third with 83 companies. Like China, it has a very high proportion of professional service robot manufacturers, with a share of 79%. A total of 17% offer consumer applications and 12% medical robots.

From a regional perspective, the majority of service and medical robot manufacturers are based in Europe, with a global market share of 44%, Asia with 29%, and the Americas with 25%.

The IFR noted that its World Robotics Service Robots report is based on sample data, which is projected to the whole industry. Its sample composition varies each year. The federation discouraged compiling or comparing data from different World Robotics reports.

The IFR added that its statistics in the World Robotics Service Robots 2024 report are based on a sample of 298 service robot producers. Its full report can be ordered online, along with the latest report on industrial automation.

Click here to enlarge. Source: IFR