|

Listen to this article |

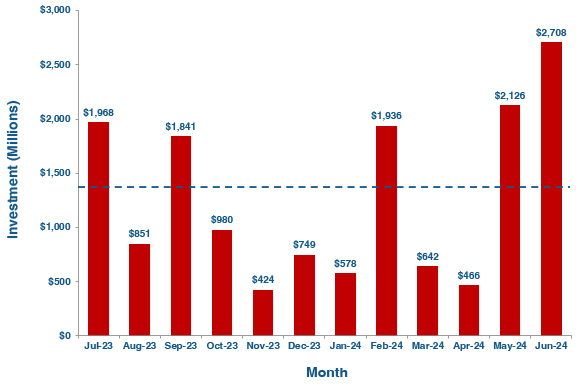

Forty-eight companies that make robots or relevant enabling technologies raised a total of $2.7 billion in June 2024. At press time, this was the highest monthly funding total of 2024. It exceeded May’s total by more than $500 million and was more than double the 12-month trailing investments average of $1.3 billion. Robotics investments for the first six months of 2024 totaled about $8.4 billion.

The largest investments were, once again, raised by developers of autonomous driving technologies. San Francisco-based Cruise raised $850 million from owner GM as it restarts its on-road operations. Aptiv raised $816 million, Waabi $200 million, 42dot $185 million and Tier IV $54 million. It should be noted that these five companies raised more than $2.1 billion alone in June.

June 2024 Robotics Investments

| Company | Amoun | Round | Country | Technology |

|---|---|---|---|---|

| 42dot | $184,707,511 | Other | Korea | Autonomous driving |

| Aegeus Technologies | Estimate | Other | India | Outdoor mobile robots |

| Aptiv | $816,127,550 | Other | Ireland | Autonomous driving |

| Arbe | $29,482,238 | Other | Israel | Software |

| Astribot | Estimate | Series A | China | Humanoids / bipeds |

| Avidbots | Estimate | Series D | Canada | Indoor mobile robots |

| Beijing Xianwei Medical Technology (Xianwei Medical) | Estimate | Seed | China | Surgical robots |

| BOTINKIT | $13,760,268 | Series A | China | Robotic kitchen |

| Botsync | $5,200,000 | Series A | Singapore | Indoor mobile robots |

| Bright Machines | $126,000,000 | Series C | USA | Robot arms |

| Cheelcare | Estimate | Grant | Canada | Consumer robots |

| Cruise | $850,000,000 | Other | USA | Autonomous driving |

| DeepForest Technologies | $1,266,926 | Series A | Japan | Drones |

| deepsafety | Estimate | Seed | Germany | Sensors |

| Delivers AI | Estimate | Seed | Turkey | Outdoor mobile robots |

| Drone Harmony AG | $2,244,668 | Other | Switzerland | Software |

| Esper Bionics | $5,000,000 | Other | USA | Prosthetics |

| Euler Robotics | Estimate | Seed | Korea | Robot arms |

| Formic Technologies | $27,400,000 | Series A | USA | Robot arms |

| Galaxy Bot | $96,406,781 | Seed | China | Humanoids / bipeds |

| Gatik | Estimate | Other | USA | Autonomous driving |

| GrayMatter Robotics | $45,000,000 | Series B | USA | Robot arms |

| Hummingdrone | Estimate | Other | Turkey | Drones |

| InOrbit | $150,000 | Grant | USA | Software |

| IVY TECH | $335,817 | Grant | UK | Outdoor mobile robots |

| Jingshi Technology | Estimate | Other | China | Humanoids / bipeds |

| Kinetic Automation | $21,000,000 | Series B | USA | Robot arms |

| LoopX | $183,039 | Grant | Canada | Indoor mobile robots |

| Luffy AI | Estimate | Other | UK | Software & sensors |

| Man-Machine Synergy Effectors | $949,608 | Other | Japan | Exoskeletons |

| MORFO | Estimate | Seed | France | Drones |

| MUSE | $3,627,985 | Seed | Japan | Indoor mobile robots |

| Polaris3D (Ereon) | $10,934,618 | Series B | Korea | Indoor mobile robots |

| Puncture Robotic | Estimate | Series B | China | Surgical robots |

| Rhoman Aerospace | Estimate | Other | USA | Software |

| Robo Arete | Estimate | Other | Korea | Robot arms |

| robolaunch | $1,500,000 | Seed | Turkey | Indoor mobile robots |

| Ronovo Surgical | $41,349,082 | Series B | China | Surgical robots |

| Sealien | Estimate | Seed | China | Underwater drones |

| Skye Air Mobility | $4,002,183 | Series A | India | Drones |

| Skysys | $13,903,564 | Series B | China | Drones |

| Swaayatt Robots | $4,000,000 | Seed | India | Software & sensors |

| Tier IV | $53,948,729 | Series B | Japan | Autonomous driving |

| trexo robotics | Estimate | Grant | Canada | Rehabilitation robots |

| Vecna Robotics | $40,000,000 | Series C | USA | Indoor mobile robots |

| VersaTile Automation | $10,119,204 | Seed | UK | Indoor mobile robots |

| Waabi | $200,000,000 | Series B | Canada | Autonomous driving |

| Youibot | Estimate | Series C | China | Indoor mobile robots |

Robotics technologies for manufacturing operations also attracted substantial investment. Bright Machines attracted $126 million Series C funding. GrayMatter Robotics, a provider of an AI-powered solution that enables robots to self-program, raised $45 million in Series B funding. And Formic Technologies, a developer of turnkey robotic solutions as a service, raised $27.4 million in Series A funding.

Companies based in the U.S. and China received the majority of the funding rounds in June with 10 each. Once again, firms based in the U.S. attracted the most funding at approximately $1.1B, while Aptiv’s $816 million round was enough to boost Ireland into 2nd place. Five companies in Canada secured a total of $225.6 million, while four companies in both Korea and Japan received $198 million and $59.8 million in funding, respectively.

Global robotics investments for previous 12 months. | Credit: The Robot Report

Editor’s Note

What defines robotics investments? The answer to this question is central in any attempt to quantify them with some degree of rigor. To make investment analyses consistent, repeatable, and valuable, it is critical to wring out as much subjectivity as possible during the evaluation process. This begins with a definition of terms and a description of assumptions.

Investments

Robotics investments should come from venture capital firms, corporate investment groups, angel investors, and other sources. Friends-and-family investments, government/non-governmental agency grants, and crowdsourced funding are excluded.

Robotics Companies

Robotics companies must generate or expect to generate revenue from the production of robotics products (that sense, analyze, and act in the physical world), hardware or software subsystems and enabling technologies for robots, or services supporting robotics devices. For this analysis, autonomous vehicles (including technologies that support autonomous driving) and drones are considered robots, while 3D printers, CNC systems, and various types of “hard” automation are not.

Companies that are “robotic” in name only, or use the term “robot” to describe products and services that do not enable or support devices acting in the physical world, are excluded. For example, this includes “software robots” and robotic process automation. Many firms have multiple locations in different countries. Company locations given in the analysis are based on the publicly listed headquarters in legal documents, press releases, etc.

Verification

Funding information is collected from several public and private sources. These include press releases from corporations and investment groups, corporate briefings, market research firms, and association and industry publications. In addition, information comes from sessions at conferences and seminars, as well as during private interviews with industry representatives, investors, and others. Unverifiable investments are excluded and estimates are made where investment amounts are not provided or are unclear.