Payments company Nala pivoted to offer remittance service in 2021, tapping the growing money transfer market in Africa, and demand for reliable and affordable services. Nala founder, Benjamin Fernandes, said they intended to build their products on this premise right from the outset.

Over the last two years, the Tanzanian fintech, through its consumer fintech app, has enabled users in the diaspora including the EU, UK and US to send money to their loved ones across 249 banks and 26 mobile money services in 11 African markets. For markets like Kenya, they have integrated with mobile money service M-Pesa enabling users living in the diaspora to pay local bills directly.

However, building the service on the payment rails of other providers meant that the fintech could not guarantee dependability. This drove the decision to develop its own platform that directly integrates with banks and mobile money providers. A B2B payment platform dubbed Rafiki, Fernandes says, is their solution to stem payout incidences, minimize user charges and ensure reliability, as the fintech looks to scale.

“We built the Rafiki infrastructure, not by choice, but by the nature of the market. When we started, we were experiencing 15% failure rates from partners as we started to scale, and this affected our cost of operations massively. The only way to solve this problem was at the source, to get licenses and build payment and treasury infrastructure reliably,” said Fernandes, while talking about the product publicly for the first time. The product is currently accessible to a select few.

“We believe reliability is a premium in the market and an opportunity to enable global businesses to trade more effectively with Africa. We have split our teams at the company to operate Rafiki and Nala independently. We have signed a few large contracts with global payments and remittance companies, which we will be announcing in the next few months.”

As Nala’s Rafiki powers its consumer fintech app, the cross-border payments platform also targets global businesses making payments into and out of Africa. This means that global remittance and payroll companies integrating with Rafiki can, for instance, make direct deposits into their recipients’ mobile money wallets or bank accounts.

With the infrastructure in place, Nala also plans to venture into payments processing for businesses as part of its quest to solve a reliability “problem at scale for global businesses that want to trade with Africa.”

Nala scales and reaches profitability

As it gears up to scale in new markets, Nala recently hired ex-Wise staffer Andrei Klevtsov as its head of finance, and ex-Currency Cloud executives Will Staples, and Jan Philippaerts as heads of risk and compliance, and Operations, respectively.

The company’s scaling plans come against the backdrop of Nala’s revenue growth, which Fernandes said grew 10 times in the last 12 months as its consumer product saw an increase in user base. The remittance business growth coincides with reports that remittance flows to sub-Saharan Africa will continue on a growth trajectory. According to the World Bank the amount of remittance flows to sub-Saharan Africa are expected to have increased to $54 billion in 2023, a 1.9% growth, driven by key markets like Nigeria and flow growth in Mozambique, Rwanda and Ethiopia. Notably, the inflows figure is much higher when historical data from Remitscope and transfers done through informal markets as this report states, are taken into consideration.

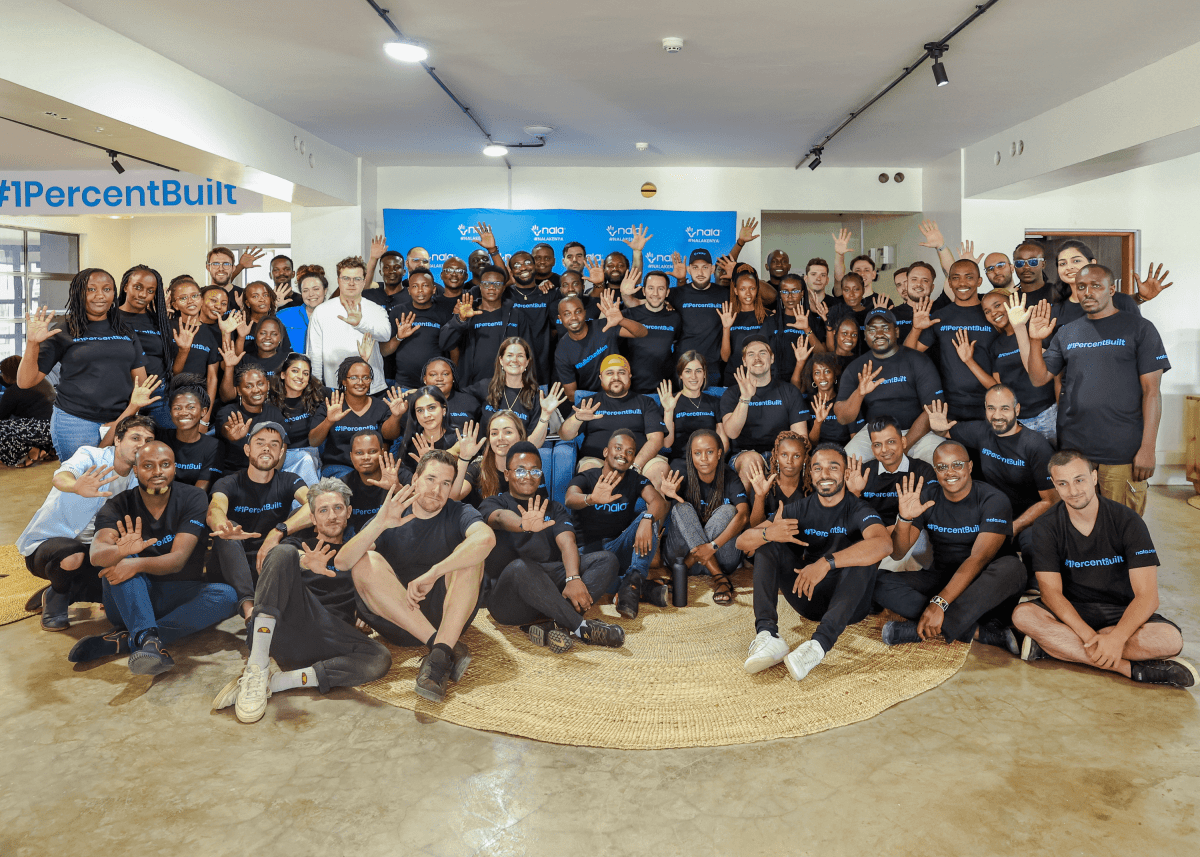

“The past two years, our team has been heads down on unit economics, focusing on our foundation for our business. We didn’t have large budgets to spend on scaling and decided it would be best if we focus on retaining customers and growing revenue before building for scale. In the past 12 months, we have grown revenue 10x. It’s not been easy and our team has worked very hard. As a company, we are finally profitable,” said Fernandes, a Tanzanian.

Nala is backed by Accel, Amplo and Bessemer Partners, and is among the fintechs in the digital payments space in Africa where heavyweights like Flutterwave, Cellulant and Onafriq operate. These fintechs help users to bypass the sometimes-restrictive traditional banking infrastructure by allowing the processing of payments online and offline through USSD or STK commands, over apps or using NFC technology.

Yet, while there exists more than a dozen payment solutions in Africa, there is plenty of room for innovation, according to Financial Technology Partners, an investment banking firm focused exclusively on fintech. In a past review of the sector the firm said Africa is still a fertile ground for ideas and innovations as “roughly 90% of payments are still made using cash, more than half of all Africans are unbanked or underbanked, and only a small minority hold a debit or credit card.”

“Africa has all the ingredients needed to develop a robust fintech ecosystem including a massive, young, unbanked and underbanked, tech-savvy population, traditionally heavy cash usage, rapid shift from informal to formal sectors, increasing mobile penetration, and a generally-favorable regulatory environment along with governments pushing for greater financial inclusion and digitization,” it said.